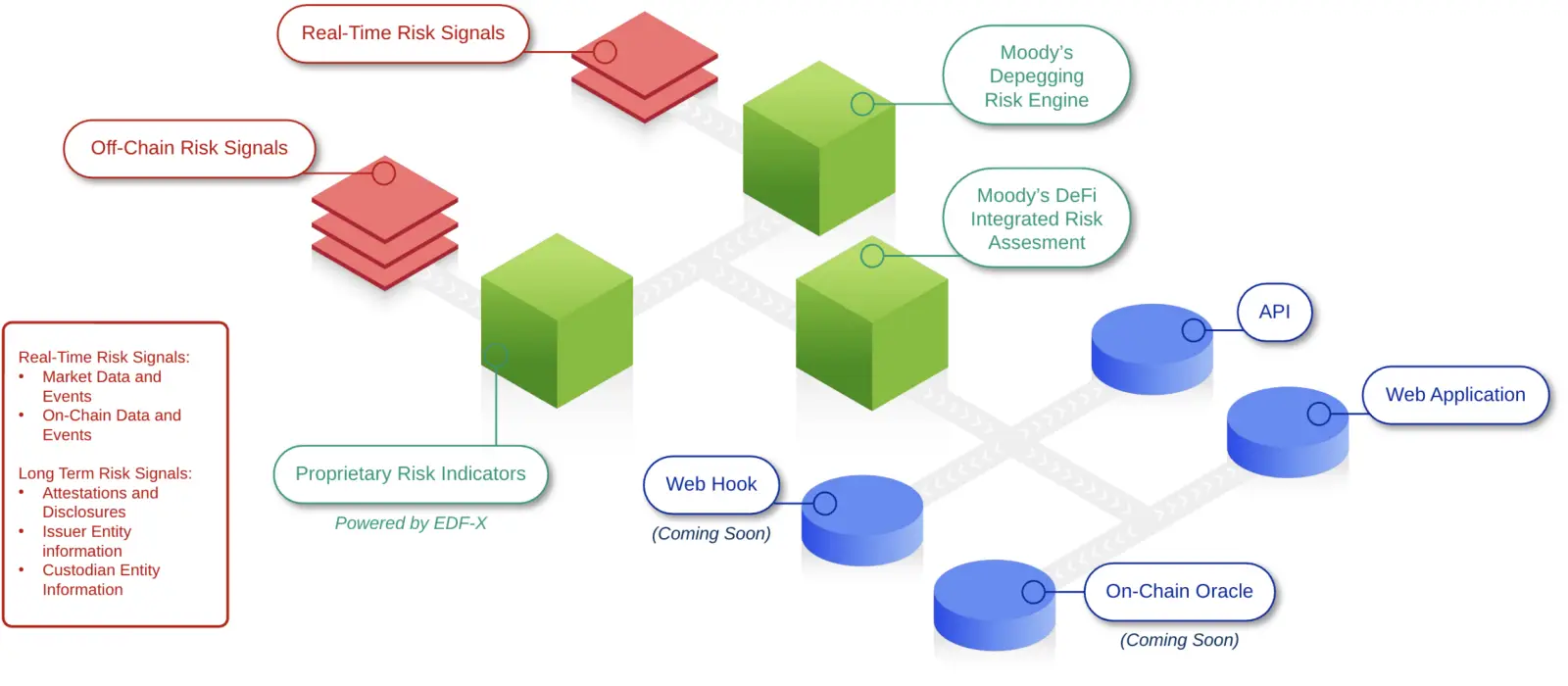

Moody's Analytics recently launched it's Digital Asset Monitor product, an AI-based risk assessment platform for the monitoring and prediction of depegging events of stablecoins. As a co-author of the DeFi Integrated Risk Assessment (DIRA) methodology, I'm excited to see this work come to fruition, as well as the feedback we have received from the market thus far.

Below, I've provided a quick summarization of stablecoins, as well as a description of the Digital Asset Monitor product. I encourage readers to check out our whitepaper and the product page as well!

Schematic of Moody’s Digital Assets Monitor. Source: Moody’s

What is a Stablecoin?

A stablecoin is a type of cryptocurrency that is designed to maintain a stable value relative to a specific asset or basket of assets, such as fiat currencies like the US dollar, commodities like gold, or even other cryptocurrencies. Unlike most cryptocurrencies, which can be highly volatile in terms of price fluctuations, stablecoins aim to provide a more predictable value, making them suitable for various use cases like payments, remittances, and as a medium of exchange in cryptocurrency trading.

There are different types of stablecoins, including:

- Fiat-collateralized stablecoins: These are backed by reserves of fiat currency, such as the US dollar or the euro, held in a bank account. Each stablecoin issued is supposed to be backed by an equivalent amount of fiat currency held in reserve.

- Crypto-collateralized stablecoins: These stablecoins are backed by a reserve of other cryptocurrencies. The value of the reserve assets should ideally exceed the value of the stablecoins issued.

- Algorithmic stablecoins: These stablecoins use algorithms to maintain their stability without the need for collateral backing. They adjust the supply of stablecoins based on various factors like demand and market conditions to keep the price stable.

Stablecoins are often used as a hedge against the volatility of other cryptocurrencies or as a way to facilitate trading and transactions in the crypto ecosystem without the need to convert back and forth into fiat currencies.

What are some use cases for Stablecoins?

Stablecoins have a variety of use cases due to their stability compared to other cryptocurrencies. Some common use cases include:

- Remittances: Stablecoins can be used for cross-border remittances, allowing individuals to send money across borders quickly and at a lower cost compared to traditional remittance services.

- Payments: Stablecoins can be used for everyday transactions, similar to traditional fiat currencies. They can be used for online purchases, peer-to-peer payments, and in-store transactions, providing a faster and more efficient alternative to traditional payment methods.

- Hedging: Traders and investors use stablecoins as a hedge against the volatility of other cryptocurrencies. By converting their holdings into stablecoins during periods of market instability, they can preserve the value of their assets and mitigate losses.

- Decentralized Finance (DeFi): Stablecoins are a fundamental component of many decentralized finance applications. They serve as a stable medium of exchange, unit of account, and store of value within the DeFi ecosystem, enabling various financial services such as lending, borrowing, yield farming, and liquidity provision.

- Micropayments: Stablecoins can facilitate micropayments, allowing users to make small transactions with minimal fees. This use case is particularly relevant for digital content creators, who can receive payments in stablecoins for their work without being subject to high transaction fees.

- Tokenization of Assets: Stablecoins can be used to tokenize real-world assets such as real estate, commodities, and securities. By representing these assets on a blockchain using stablecoins, ownership can be transferred more efficiently, and fractional ownership can be facilitated.

- Cross-border Trade: Stablecoins can streamline cross-border trade by reducing the time and cost associated with currency conversions and international transactions. Businesses can use stablecoins to settle payments with suppliers and customers in different countries more efficiently.

Overall, stablecoins offer a versatile and efficient means of transferring value within and across various sectors, contributing to the growth and adoption of blockchain technology and cryptocurrencies.

What does the Digital Asset Monitor do?

I've provided a brief quote from the summary of the project white paper which I think provides a good overview:

In summary, the framework uses both on-chain and off-chain data sources to inform a prediction of a risk of depegging for a given stablecoin. This can have broad applications for anyone doing both short or long term transacting with stablecoins.